Toronto Condo Market Report • Sept 2021

Affordability in housing and not sale numbers has taken over the real estate discussion for most people with the politicians jumping on board. For 2021 year-to-date, the number of sales under $600,00 was 13,049 units or 15% of total sales on TRREB. In 2020 to the end of August, the numbers were 13,437 and 23%. While the drop-in units sold was just 3%, for the same period, year-to-date sales for the total market from 2020 to 2021 were up by 52%! When you look at the sales-to-new listing ratio, prices can only go up from here. Currently we are at a decade old low for listings!

So, what is the answer: not government housing or purpose-built rental housing. Rather governments need to work together to build Co-Op housing. Non-profit Co-Op housing usually requires a small down payment to buy a share in the Co-Op and the Co-Op itself gets a mortgage on the whole property. People living in these units are responsible for paying and operating the Co-Op. Governments can also be responsible for buying the land and speeding up municipal approvals. The result is that you can reduce construction costs by 40% and create a pride of ownership which is non-existent with renters.

Sales to new Listing Ratio compared to average annual price per cent change in home price

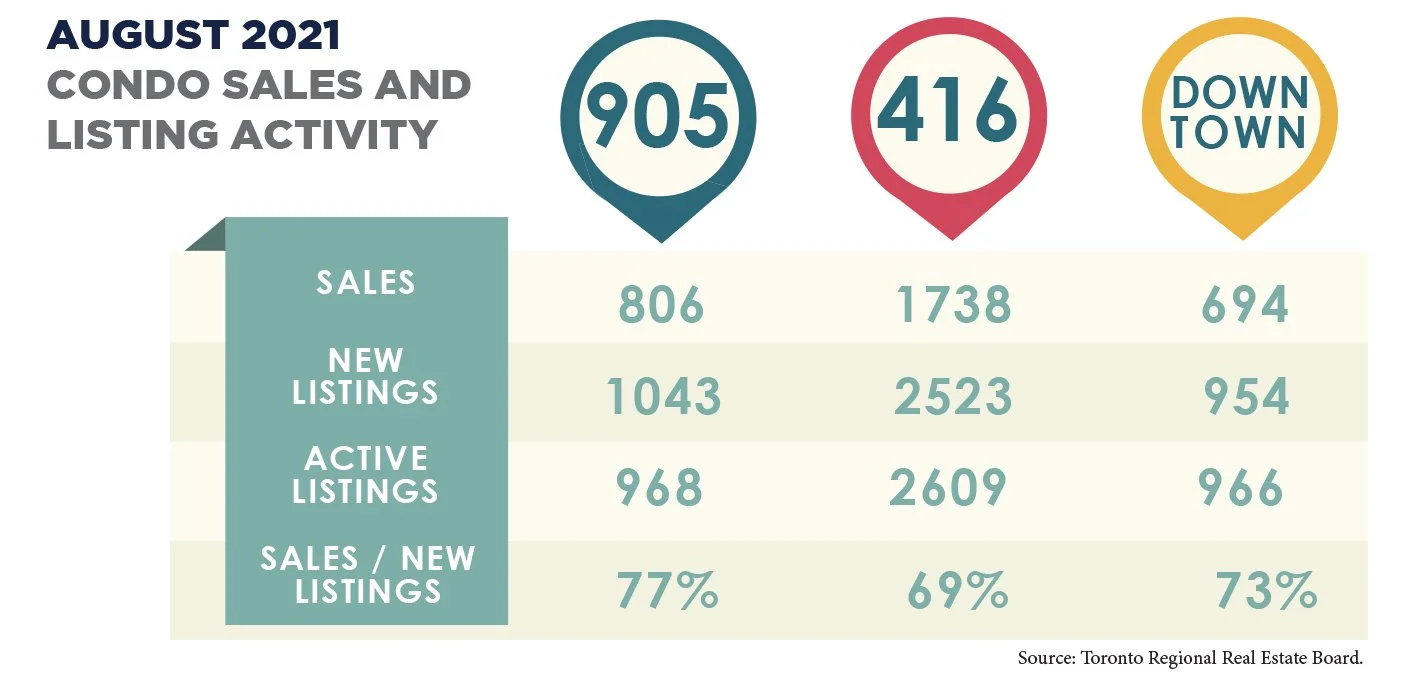

Affordability also leads to a discussion of the condo market. (Toronto is one of the few major cities of the world with low rise housing). While condos and particularly downtown condos underperformed the market in 2020, we forecast a strong rebound in 2021. Overall sales in August of 2021 were 20% lower than in 2020 at 8600 units but condo sales were 11% higher than in August of 2020. Not only are condo sales higher this August, but ‘new’ and ‘active’ listings in 2021 are now 37% and 43% lower than this time last year. All indications are that condo prices will continue to increase over the fall months.

Affordable Condos at 5 Massey Square

The Massey Square complex of condos is in Crescent Town, a 10-minute walk to the Victoria Park subway station. Yes, the building is 48 years old, but the units are large and VERY affordable. Condo fees are high because all utilities are included. Expect to pay $750-800 per month but property taxes are just under $1,000 per year. Because of high condo fees, this is not an attractive building for investors and hence end-users should not expect multiple offers or being outbid by investors.

In looking at 58 sales over the past two years, the lowest price was $310,000 and the highest was $549,00 (for a townhouse). The average sale price was $415,000.

I examined a two-bedroom unit that sold at the start of Covid in March of 2020 for $440,000 and sold a year later in 2021 for $460,000 which represents an annual increase of 5%. This is considerably below the 13% average increase for all condos in the 416

Currently there are 10 units for sale with a maximum list price of $499,900 for a two-bedroom at over 900 sf. The average selling price is $500 psf – less than half the average price in downtown for a newer condo.

If buyers want to look at the west side, consider 940 Caledonia Rd. It is in the Yorkdale/Glen Park area. The economics are almost identical to Massey Square. It is an older building with high condo fees because all utilities are included. Property taxes are also around $1,000 per year and prices are also at $500 psf on average. Currently there are 3 properties for sale – all just under $400,000.

First time buyers can still get into the market. One just needs to adjust one’s expectations

GET IN TOUCH