Use Leverage To Get Rich

More millionaires are created through real estate than any other form of investment. The ability to use leverage in your investing strategy is critical to maximizing the wealth you are building and is the most important reason why real estate needs to be a part of your investment portfolio.

What is Leverage in Real Estate?

Leverage is using only a small amount of your own money to buy a property that you own.

When buying real estate, you can finance its purchase by putting down only a small, partial payment, known as “the deposit” or “the down-payment” and borrow the rest of the funds “the mortgage” from a lender. This allows you to increase the potential return of your investment because you are not financing the entire purchase price yourself and can instead use any extra funds for additional investments. This has a compounding and exponential effect on how much wealth you can build and how quickly.

A Practical Comparison

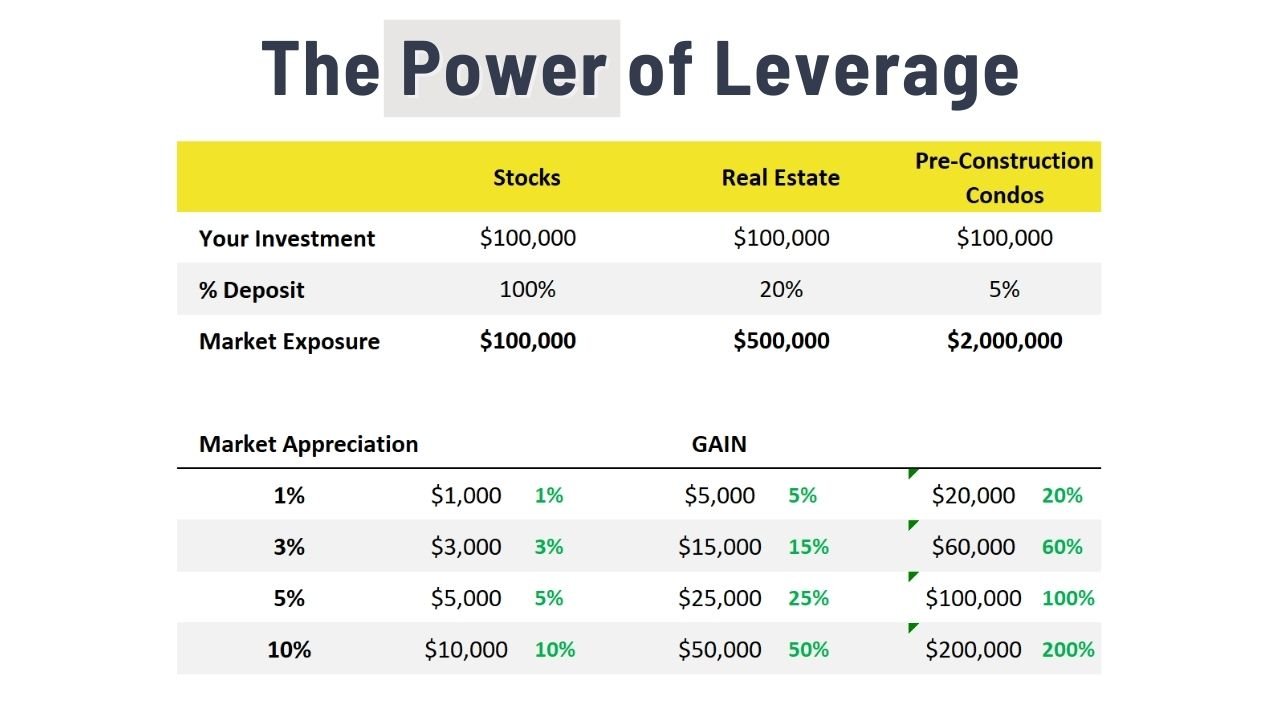

When you buy an investment like stocks, GICs, cryptocurrency, trading cards, etc. you typically must pay the entire purchase price. $100,000 invested gets you $100,000 “exposure to the market”. This means that if the market goes up 1%, you earn a return of $100,000 x 1% = $1,000.

When you buy real estate, you can put down the same $100,000 as a 20% down-payment on a property worth $500,000 (you simply borrow the $400,000 difference from the bank). If the market goes up 1%, you earn a return of $500,000 x 1% = $5,000 (5X MORE).

When you buy pre-construction condos, this concept is further maximized. If you can find the holy grail of real estate investments that require only a 5% deposit until closing, the same $100,000 can buy you $2,000,000 in market exposure. If the market goes up 1%, you earn a return of $2,000,000 x 1% = $20,000 (20X MORE!)

What’s even better is that because they are pre-construction condos, you don’t get a mortgage until CLOSING (i.e. when the unit is complete) in several years, so you aren’t even borrowing any money yet so there aren't any interest payments!!

Why You Must Be Using Leverage in Real Estate

Leverage is the “secret sauce” that rich people use to get richer and they do this every day in their personal and business lives (name me one Fortune 500 company that does not have a loan, i.e. “borrowed money”).

Build An Instant Portfolio

Real estate investing is not a get rich quick scheme and it takes several years for the full benefits to be realized. Using leverage multiplies your money and allows you to buy more property today than you could otherwise afford. Looking at it another way, your $100k invested in stocks today could buy you $500k of real estate or $2M of pre-construction condos. This allows you to build an instant real estate portfolio that can literally mean the difference between securing your financial future/retiring early or struggling to pay your bills.

Over 30 years at a modest 3% annual appreciation, the pre-construction portfolio will be worth $2.7M (1,900%) MORE than the stock portfolio! This is more than most Canadians even have in savings!

What's not even included here is that after 30 years:

Your tenants will have paid off the mortgage and the property is now free and clear

You are still renting the property with no mortgage and getting significant cash flow in your retirement when you need it

Since the property’s value has likely gone up many times, you can take out 80% of the equity (tax free) to buy other investments!

NOTE: This IS an exaggerated example, but it shows you the power of adding even 1 or 2 pre-construction condos into your investing portfolio.

Loans Are Not Bad

With the rise in popularity of financial movements that shame people living beyond their means, borrowing money and loans have gotten a bad reputation. Don’t get me wrong, borrowing money to fund your lifestyle and expenses is not good – always live within your means – but borrowing money to fund your investments can mean securing your financial future when it otherwise would not have been possible.

Banks LOVE to give mortgages out because the loan is secured by the property itself. For most of my investing clients, they can typically qualify for 4-5 mortgages pretty easily worth up to 5x their annual income (note-please consult a mortgage professional to evaluate your unique personal situation).

This is how you build generational wealth, not by working a day job.

Diversification & Managing Risk

If you put all your money into one investment, regardless of what it is, you are putting "all your eggs in one basket" which is never a good thing. Leverage will help you buy real estate and diversify your portfolio beyond stocks, GICs, crypto, etc. I have no idea which asset class is going to outperform the others and past performance does not indicate future performance. Having a well balanced investment portfolio is one of the most consistent pieces of advice from financial experts. Diversification helps even out the investing ups and downs (e.g. I personally got absolutely crushed in the stock market crash of 2008 while the real estate market in the GTA just went sideways for a few months).

Adding a few rental properties can also help manage risk within your real estate portfolio because it allows you to:

Diversify Within Real Estate: This is like buying an ETF on an index versus buying individual stocks. You can get exposure to different areas of a city or different cities all together because "stock picking" is a fool's errand.

Balance Cash Flow: If cash flow at one property is negative and one is positive, they can balance to zero across your real estate portfolio at tax time. This can help finance properties with strong appreciation potential but poor cash flow positions

Manage Vacancies: Eventually you will need to find new tenants and your property may be empty for a month or two. Having multiple properties allows your other units to cover the majority of expenses during the vacancy (e.g. if you have one property and it is vacant, then 100% of your income is affected, if you have 2 properties and 1 is vacant, only 50% of your income is affected).

What Are The Risks of Using Leverage?

Leverage In Reverse

Yes, leverage is amazing when markets go up, but it works in reverse if markets go down and your losses are multiplied using leverage. However, people have been calling for the “bubble” in Toronto real estate to burst for the last 20 years and it just hasn’t happened. I truly believe that real estate in major Canadian cities will be worth more in 5 years, 10 years, and definitely more in 30 years, so this is not a consideration for me – if markets go down, I will just hold on to the property with the tenants paying the rent while I ride out the bad market conditions (this is what I advised my clients to do with Covid and prices are higher than before Covid). You only realize a loss if you sell the property.

Loss of Income

If you aren’t getting income from your unit because it's vacant, tenants aren’t paying rent, or whatever reason, this can affect your personal finances because you still need to pay the mortgage and monthly expenses. This could lead to profit losses or negatively affect your net worth if the value of the property goes down. Doing due diligence on your real estate investments and thoroughly vetting prospective tenants will go a long way to mitigating this risk.

Final Thoughts

Leverage is the tool that many rich people use to build wealth in their personal and business lives. However, it is not accessible to only the elite – virtually anyone can get a mortgage and start building a real estate portfolio!

Most of the risk related to leverage can be mitigated by wisely managing your real estate investments and the increased financial benefits outweigh the risks long-term.

Leverage is a tool that I use but each person’s situation and investing objects are different. Talk to your real estate investing team (agent, account, lawyer, mortgage broker, financial manager, etc.) to see if using leverage is the right fit for you.