Property Tax Calculator

When performing a cash flow analysis, a critical component too understand is how much the property taxes are. Every city sets their own property tax rates, so use the calculator below to understand the tax rates in major Canadian cities. Paying property taxes is always the responsibility of the owner of the property.

Assessed Value

Property taxes are always based on the Assessed Value of the property, as determined by the municipal property assessor (MPAC in Ontario). The assessed values tend to be conservative and are typically a bit below the purchase price of the property. Assessed values do not include GST or HST, so remove this if you are using your purchase price for a pre-construction property.

Property Taxes

Property taxes are the primary source of revenue for local governments and are used to fund a wide range of public services and infrastructure, including:

1. Education

A significant portion often supports public schools, including teacher salaries, facilities maintenance, and educational programs.

2. Public Safety

Funding for police, fire departments, and emergency medical services.

Maintenance of 911 systems and disaster preparedness efforts.

3. Infrastructure

Maintenance and improvement of roads, bridges, and public transportation.

Snow removal, street cleaning, and traffic management.

4. Parks and Recreation

Upkeep of parks, playgrounds, and recreational facilities.

Programs like youth sports leagues and community events.

5. Public Health

Local clinics, health inspections, and wellness programs.

Management of public health crises.

6. Municipal Services

Garbage collection, recycling, and water/sewer systems.

Libraries, community centers, and public housing projects.

7. General Government Operations

Administrative costs for running city or county offices.

Salaries for local government employees.

8. Debt Repayment

Paying off bonds or loans used for large capital projects like new schools, highways, or utility plants.

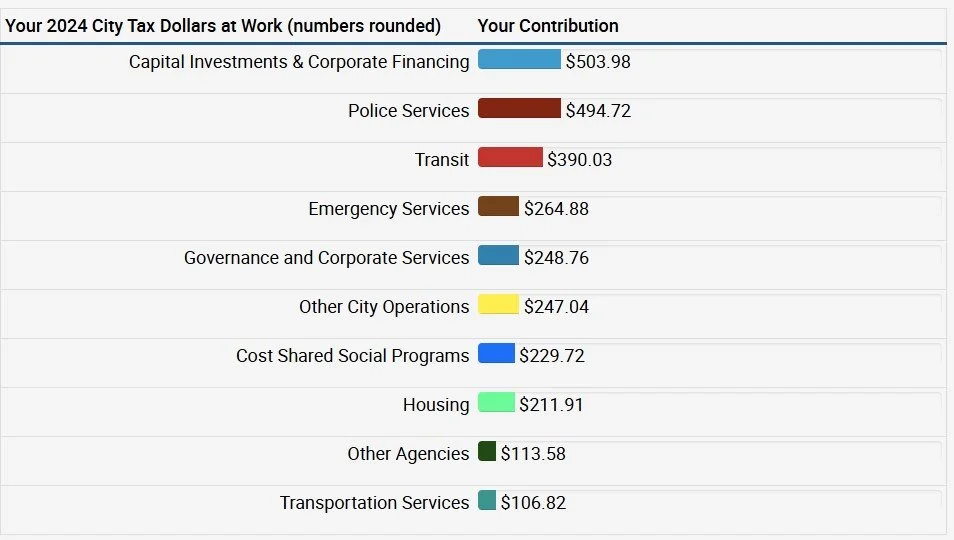

Here’s a breakdown of how Toronto property taxes are being spent in 2024 as an example: