2022 Toronto & GTA Market Forecast

Today I'm going to use my crystal ball to predict what is going to happen in 2022.

FACTORS THAT WILL IMPACT THE MARKET IN 2022

1) Interest Rates: Interest rates on mortgages are going up - this is now a certainty - how high and how quickly the go up is anyone's guess though and it will depend on many macro and micro-economic factors. I expect the Bank of Canada to raise the target for the overnight rate 3-4 times this year which equates to a 0.75-1% rise in interest rates. This would put variable rates around 2% by the end of the year and I don't expect fixed rates to rise significantly because these are more dependent on long-term bond yields. Buyers are still required to qualify for mortgages at 5.25% so this won't have a significant impact on buyer demand.

2) Inflation: the price of everything is increasing and labour shortages are real. I don't expect these to be fully resolved in 2022 as they depend heavily on complex global systems. Case in point, I tried ordering a PAX wardrobe from Ikea recently and they told me their wait time is 2 years!!! This has already caused new construction prices to spike and the resale market will also be impact by these price increases.

3) Immigration: Canada is an incredibly desirable country to move to internationally, especially as geopolitical risk continues to increase (look at Russia and Ukraine). Immigration did not fully meet forecasted levels in 2021 but expect the federal government to exceed their goal of 400,000 immigrants in 2022 (the vast majority land in major cities and about 1/3 of all in the GTA). The Canadian government has also recently increased their immigration targets:

2022: 431,645 permanent residents

2023: 447,055 permanent residents

2024: 451,000 permanent residents

4) Listings: Listings in Toronto are currently at 20 year lows. People are continuing to stay put in their current homes because of the lack of restrictions due to Covid and free movement regionally, inter-provincially and internationally.

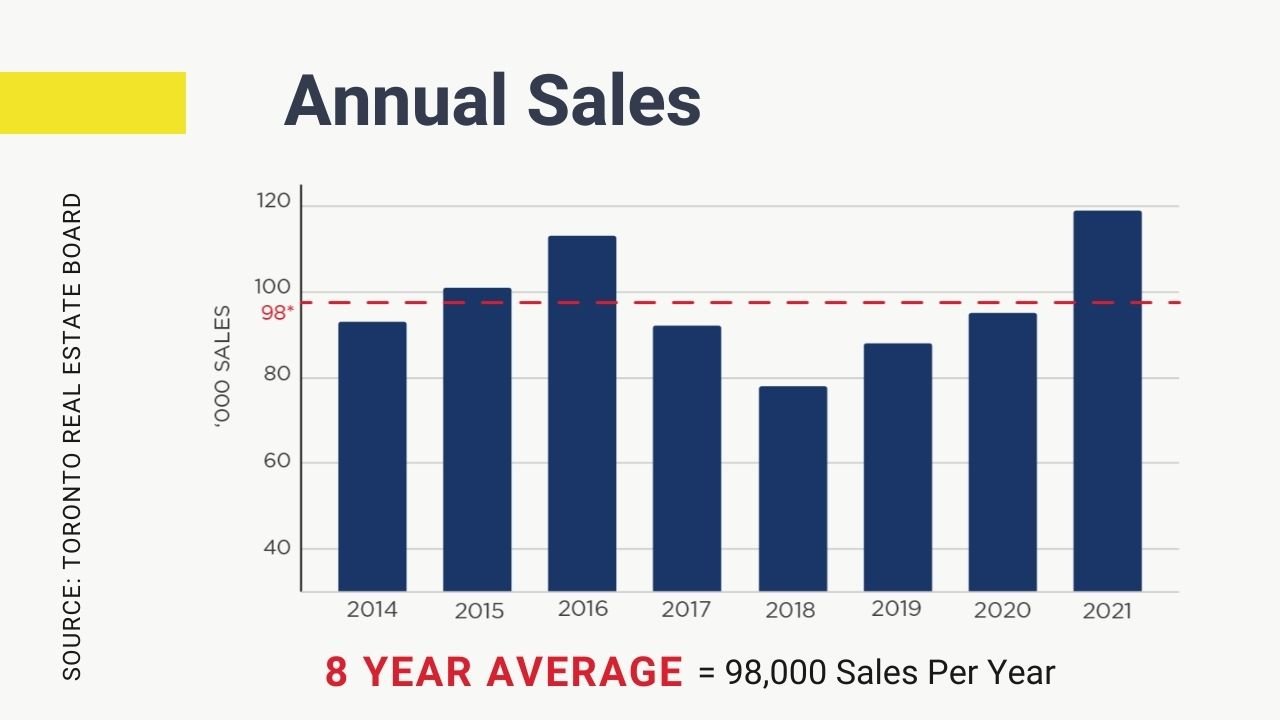

2022 SALES FORECAST

2021 was a record sales year! We saw this in many other markets like Calgary as well - Canadian real estate was on fire! I don't expect to see record number of units sold but I do not expect a steep decline either. MANY people have given up trying to find a house or have decided to stay in their current homes and renovate instead. Unless something happens that cripples the economy or deters home ownership, I don't see significant listings being added to the market and I expect levels to stay flat from 2021. Expect bidding wars and tight market conditions to prevail through 2022 regardless of rising interest rates.

2022 PRICE FORECAST

Prices are going up! I know you will say "but Kyle, they are already so high!" I know, but so many people chasing a very low inventory will continue to put upward pressure on prices across the board. I expect resale condo prices in Toronto and especially the core to outperform as it represents a catch-up and because the gap between freehold and condos has exploded over the last 2 years - this gap always narrows because of affordability - people get pushed into condos once the house market gets out of reach for them. Price growth will slow but a 3% gain on a $1M property is still the same absolute value as a 6% gain on a $500k property - the value increases are the same. I expect resale prices to increase 8-10% overall in Toronto and slightly below that for the GTA.

PRE-CONSTRUCTION MARKETS

The shortage of houses in the low-rise market mean that condos are the only option for many people. Key concerns about ‘affordability’ can be traced back to the lack of supply of new units in the pre-construction market. Case in point, in the GTA we need about 40,000 new units annually just to keep up with population growth. During the past ten years, we have averaged just under 30,000 units. The shortfall is now 100,000 units - here are the number of completions for the past 10 years:

I expect the 416 market to perform strongly. The best projects have always been those where people can walk, bike, or take transit. The challenge for people coming back to the office for some or all of the time is that they do not want to use the TTC and driving will become impossible if everyone has that same mentality. This concern will last another year or two but as the concerns of Covid fade, people will flock back to areas with accessible transit options.

In prime markets, expect new projects to launch at $1,500-$1,700/sf. Luxury locations and buildings will launch over $2,000/sf. The cheapest projects in the GTA will launch in around $1,200/sf in areas like Burlington and Oshawa.

GET IN TOUCH

Please get in touch if you have questions about the market or where you should be investing!