Toronto Condo Market Report • March 2022

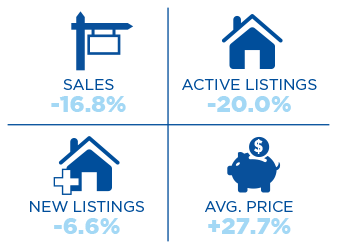

Year-Over-Year Summary

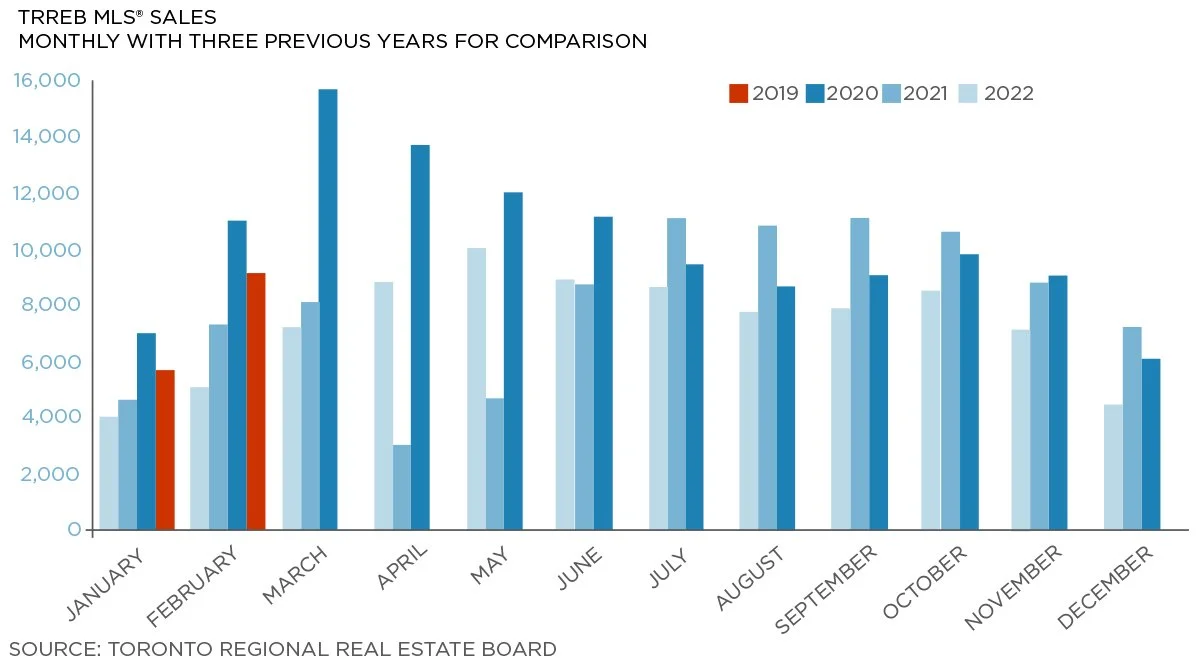

The relative sales jump due to seasonality from January to February was 61% in 2022 compared to 58% in 2021 which means that are we tracking comparable to last year. However sales in February of 9,097 were 17% lower than for January of 2021. This does not spell gloom for the market overall because 2021 was a record year for sales so a drop is to be expected. In fact, we are on pace for 100,000 sales this year which would be the third highest sales year ever. While sales are still high historically, active listings are 20% lower YoY and new listings are almost 7% lower - this lack of supply is continuing to drive prices higher with the average price rising 27.7% YoY.

The Flight To the Suburbs Is Over

Sales in the ‘416’ region were down by 14% versus 20% in the ‘905’ region. Within the ‘416’ region, detached sales were only 11% lower versus 21% in ‘905’. The flight from the downtown core looks like it is over and this is even before there is any push by companies to return workers to the office.

Low-Rise Affordability Is A Factor

Everyone loves a detached house with a white picket fence but affording one or any low-rise property for that matter is getting increasingly difficult as affordability is eroded for most people. This naturally pushes people into condos because they become the “affordable” option. This is evident where condo sales were 14% lower YoY where overall sales were 16.8%. Year-to-date in 2022, condo sales represented 32.5% of the total market while in 2021 they were 30.5%

High-End Condo Market Growing

While many people saw their life savings evaporate while trying to weather Covid, many others saw their wealth grow significantly:

The stock market initially crashed and then went on to double

Toronto average house went up up 30%+

Bitcoin went from $5,000 to $45,000

Even many sport and trading cards doubled in value

There is A LOT of money out there and it' is shown in the high-end condo market which has grown faster than the overall market. For the first two months of 2022, 48 condos over $2M were sold versus just 30 in 2021. I expect this segment of the market to continue to grow.

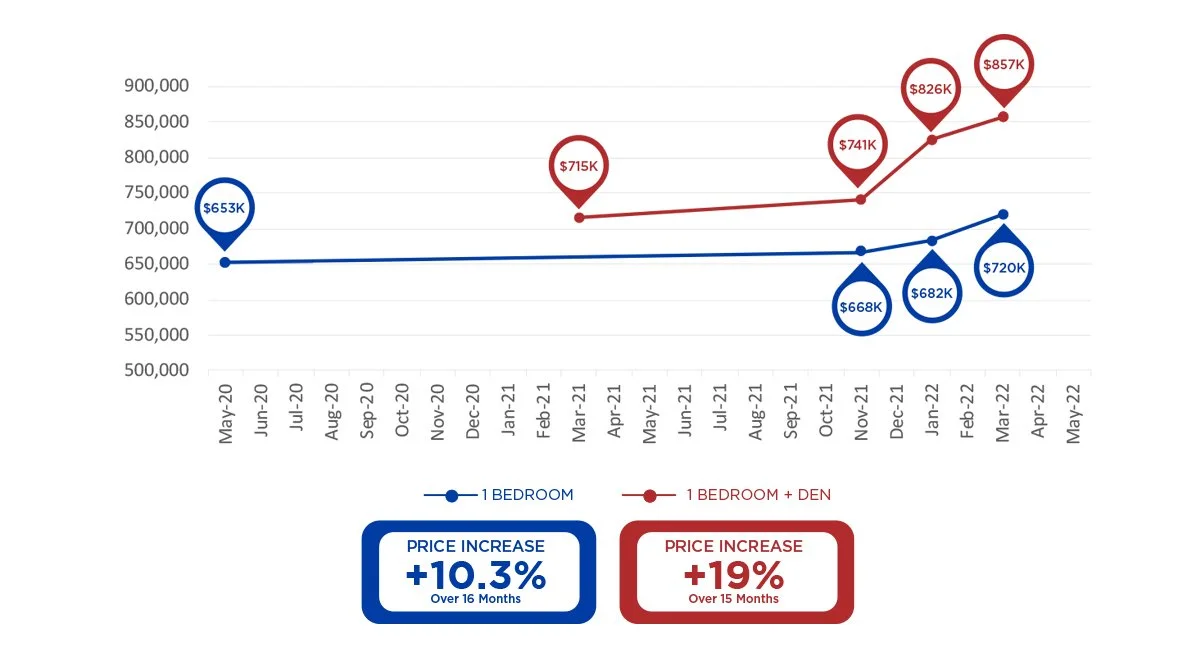

The One-Bedroom Market

It is incredibly hard to find a one bedroom condo to buy in the downtown market. I looked at sales and availability in one of the biggest condo towers downtown. College Park (the north tower) at 763 Bay is 51 storeys high and consists of 655 units. Currently there are ZERO one-bedroom units for sale. Over the last two years, there were 42 sales.

Below are the price increases for a one bedroom of with the same layout and for a one bedroom plus den. The interesting trend is that the one bedroom plus den increased faster - I think this is entirely related to the necessity of needing to work-from-home.

Rental Commentary

The supply of condos available to lease Downtown and Humber Bay was over 2,000 units by March which is about the same availability as last month. The number of condos leased in February was also similar to January at 1,451 units and demand and supply have remain unchanged with just under a 2 month supply of inventory.

To determine market trends, you need to look at the non-rent controlled buildings identify what is actually happening. Many people negotiated rent discounts or moved units because they could find cheaper rent during the start of Covid. With rent controls in buildings built/registered after November 2018 now lifted, expect tenants in those buildings to see increases of at LEAST 5%. Those units built/registered before those dates are subject to increases of only 1.2% and will skew the market numbers lower.

GET IN TOUCH