Understanding Closing Costs

Closing costs are a one time fee and refer to the various expenses and fees required to finalize a real estate transaction. These costs are transferred to the lawyer at final closing when ownership of the property officially transfers to the buyer. These costs must be paid in cash and cannot be rolled into the mortgage so don’t forge to budget them!

20% Down-Payment

Before I get into the closing costs, you must know that to qualify for a mortgage on a rental property anywhere in Canada, you need to have a minimum 20% down-payment at closing. Any deposits you have provided to the builder count towards this total and you need to come up with the difference to 20% at final closing. This money is also required in cash and needs to be added onto your closing costs! Here are same deposits required but the total amount owed depends on your purchase price and the deposit structure of your purchase:

Closing Costs

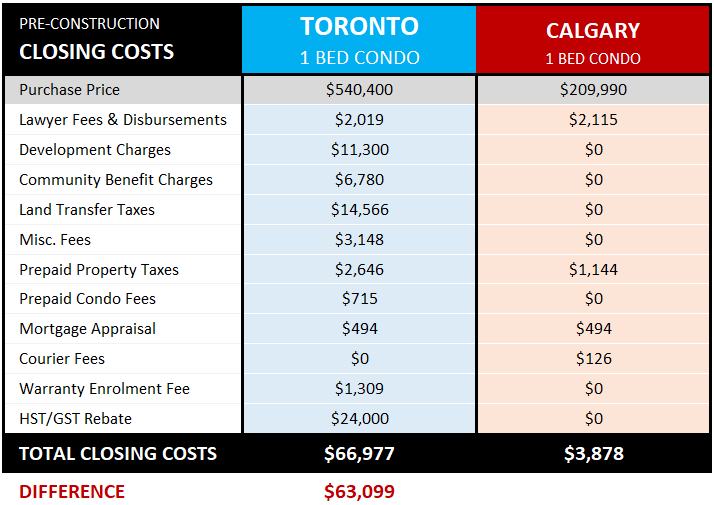

Costs vary significantly by city and province and even by project. Below are my actual closing costs I paid to close a 1 bed, 1 bath condo in Toronto VS Calgary:

Each transaction is unique but this list covers the majority of possible closing costs and should give you an idea of what to expect for closing a pre-construction property:

Lawyer Fees & Disbursements: When closing on a real estate transaction you need to use a lawyer to protect your interests and ensure that documentations is prepared and filed accurately. There are also several other mandatory fees including government & property registration fees, transaction levies, deposit compliance fees, etc. that are included in this as well.

Development Charges: These are fees collected to help pay the cost of infrastructure required to provide municipal services to the new property (roads, sewer infrastructure, community support like fire, policy, community centers, etc.). Your purchase price already includes these development charges that were applicable at the time of purchase, but there may be an increase in these fees from the time you buy the property to the time you take ownership of it. Since developers simply don’t know, they will usually give you a cap on this increase which you must pay at closing. In Alberta, there are no development charges whatsoever.

Community Benefit Charges: Also referred to as Section37 charges, that allow municipalities to collect money from new developments to fund capital costs for services and facilities needed to serve that development.

Land Transfer Taxes: This is calculated as a percentage of the purchase price of the property and varies in each province. Some cities, like Toronto, also have a municipal LTT, effectively doubling the taxes paid. There are no land transfer taxes in Alberta.

Misc. Fees: There are many other smaller miscellaneous fees that may be required like a sub-metering/utility services fee, site review/bulletin charge, status certificate fee, discharge fee, electronic registration fee, electronic document exchange fee, law society fee, financial reporting fee, trustee deposit admin fee and others.

Prepaid Property Taxes: Property taxes are usually paid on an annual basis but closings rarely fall on the first day of the year/month, so the developer will collect property taxes and remit to the city until the regular property tax payment schedule can take effect . The length of time required can vary from just a few days worth, up to nearly a whole year! These are prepaid fees and are not a true cost of closing.

Prepaid Condo Fees: Same goes with Condo Fees except the amount collected is usually not more than one month because you start to provide your condo fees directly to the condo board on the first of the next month after closing. These are prepaid fees and are not a true cost of closing.

Mortgage Appraisal Fee: An appraisal may be required by a third-party to confirm the resale value of the property for the lender. The lender may cover the expense of this but it can cost you $400 - $600 if required.

Courier Fees: If you are purchasing remotely, you may be required to courier back original signed documents to your lawyer.

Warranty Enrolment Fee: Each province has different rules and warranties that are offered for the purchase of pre-construction properties. In Ontario, the buyer typically pays the enrolment fee into the warranty program. In Calgary, the builder typically covers this expense.

HST/GST Rebate: HST/GST are applicable on the purchase of a pre-construction property and the majority of the taxes are built into the contract/purchase price already. However in Ontario, there is an HST Rebate component that must be paid in cash at closing (typically this is ~$24,000 for most purchases in the province). If you rent out the property for a 1 year lease, you can usually file a rebate application to get this back so that this expense becomes a cash flow issue and not a true cost of purchasing the property. In Alberta, there is a small GST rebate of up to $6,300 but this is usually included in the purchase price so no further cash is required at closing.

Closing costs can be an expensive part of purchasing a property and ultimately need to be added to your purchase price to determine your true cost and can significantly affect your investment returns. Investing in a low-cost area immediately sets you up to earn a higher return as these extra costs do not need to be overcome before generating a return.